This has been an interesting year for the markets and economy. There’s been a lot of change and volatility, but it’s nothing we haven’t seen before.

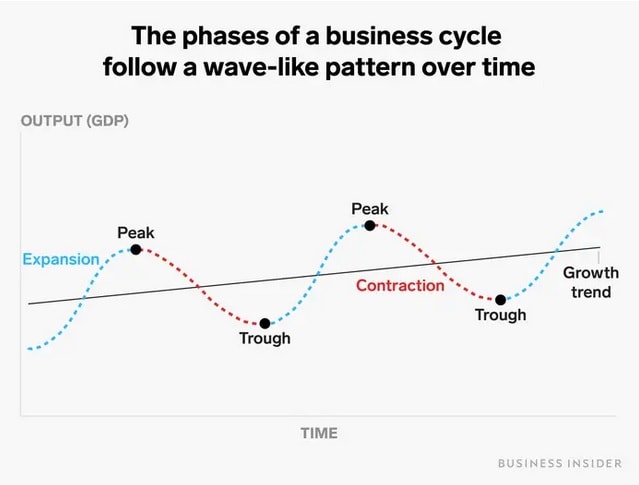

In natural business cycles, companies will grow as demand grows. They’ll beef up supplies to meet anticipated demand and do more to capitalize or build more into their buildings and equipment. But demand doesn’t go up forever. Companies will oversupply, over-hire, and over-capitalize, and then they’ll slow down for supply to meet existing demand. As jobs are lost, demand will falter, and the economy will slow. At some point, this contraction will hit its bottom. People will start new companies, find new jobs, and return to the beginning of the cycle. So, where are we now?

Are we in a recession?

Conventionally speaking, two consecutive quarters of negative GDP indicate a recession, but you’re probably hearing a lot more today than ever before about the National Bureau of Economic Research (NBER). The NBER is considered the arbiter of whether or not we are in a recession, and they do it by looking at several economic indicators beyond GDP. Based on low unemployment figures and some of the corporate earnings we’re seeing, they might make the call that we aren’t actually in a recession at this time.

What about inflation?

Inflation hit a high point in June as energy prices peaked. Without significant decreases in inflation, the Fed will continue to increase rates. Two numbers primarily drive this; the first is inflation itself, at 9.1%; the other number is unemployment. At 3.6%, we continue to be at full employment. So, as long as unemployment remains low, the Fed will continue to focus on inflation.

What does inflation mean to you? It means that the prices of almost everything you spend your money on are rising. While our average hourly earnings continue to trend upward, real wages are losing ground.

What about energy policy?

As you may know, energy is one of the factors driving inflation. Almost everything you buy is either made with fossil fuel byproducts or transported using fossil fuels. We saw oil hitting the upper limits of about $120 a barrel in the second quarter, but we’ve since seen a significant drop to around $95. So, what’s causing the decline? Is it sustainable?

In recent months, we’ve seen a quiet relaxing on the part of the administration. For example, in June, the Biden administration resumed selling oil and gas drilling leases on public land. So far, the response from oil companies to this significant policy reversal has been tepid, as many oil and gas companies are looking for more stability and assurance that they won’t be shut down by lawsuits or further reversals in policy. But this is a positive step in the right direction for bringing prices down. Another quiet development is a more favorable regulatory environment from the administration on natural gas pipelines. These energy policies and policy changes will have an impact on energy prices. In addition, Europe is looking at ways to drive down their demand for natural gas, and China’s zero-COVID policy continues to drive down demand too.

How’s the market doing?

July was the best month for the S&P 500 since November 2020, but is that sustainable? There’s not been a safe place to hide in the market this year. Every sector, including real estate and bonds, has struggled. Defensive sectors have held up the best, with consumer staples returning only a negative 4.19% on their return.

Losses are never great. But if history has taught us anything, it’s that to buy low and sell high, you have to fight your natural inclination to see a downward trend or an upward trend in the market as permanent.

What’s going on in DC?

Historically, Congress tends not to pass significant legislation before the midterms because they’re busy campaigning, but two key pieces of legislation stand out:

- Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design, and research; fortify the economy and national security; and reinforce America’s chip supply chains.

- Senator Joe Manchin (D-WV) announced an agreement with Senate Majority Leader Chuck Schumer (D-NY) to vote on the Inflation Reduction Act of 2022 to address record inflation by paying down our national debt, and lowering energy and healthcare costs.

Outlook for housing as interest rates go up

Home prices remain elevated, but we’re starting to see homes listed longer and discounts on the prices. The percentage of deals falling through has risen from about 11% to about 15%, and the mortgage rate will continue to rise in the coming months. But things are structurally different from 2008. More of the mortgages we see out there today are stronger fixed-rate mortgages with longer terms and lower rates. We seem to be on track for a slowdown in the real estate market, but not quite to the extent of what we saw with the 2008 real estate bubble.

How do you plan for retirement, financial independence, and meeting your long-term goals in today’s market?

Volatility and uncertainty in the market can lead many without a long-term plan or perspective to panic and make financial decisions based upon emotion, or try to time the market instead of investing for the long term with a managed approach to market volatility. A good long-term plan is based on average activity over time and should consider the potential for highs and lows in the economy. We suggest the following:

- Talk to your financial advisor about risk tolerance, investment and tax planning, and ensure that your plan protects your nest egg.

- Make sure you have an emergency fund, and you’re budgeting to spend less than you make.

- Know what your retirement goals are, and make sure you’re on track.

- Make sure you have proper insurance to mitigate significant financial risk.

- Check your estate plan and ensure you have the right beneficiaries listed and the right documents in place so that your wishes are fulfilled.

- Look at ways to maximize your charitable giving and help your kids and grandkids prepare for college with rising interest rates.

- Reexamine your variable rate consumer debt, and look for ways to reduce these vehicles, which are becoming more costly.

Now is a great opportunity to connect with your advisor and ensure you’re in the best position for your long-term plan. Please don’t hesitate to reach out with any questions about our webinar topics.