Key performance indicators (KPIs) are essential for business owners to track over time in order to make well-informed business decisions. This data will help business owners make decisions that directly impact the business today and in the future. KPIs should be monitored on a regular basis (monthly, weekly, etc.). The data being measured needs to be reliable and accurate in order to accurately compare and examine your KPIs. Using inaccurate data could ultimately lead to ineffective KPIs and poorly informed business decisions.

Depending on the unique characteristics of each business, there are many different KPIs that can provide valuable information to a business owner. Those could be related to customer or client activities, marketing, sales, employees, or the overall health of the company. A KPI is only useful if it is relevant to the business and aids the business owner in making business decisions that lead to higher profits or cash flow. Regardless of your industry, or niche, there are two most important KPIs that we recommend all business owners track on a regular basis Gross Profit Percentage and Operating Cash Flow.

Profit KPI: Gross Profit Percentage

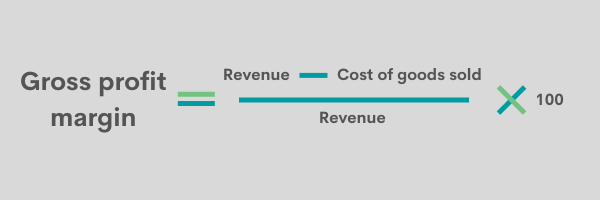

With profits being the star of the show, it’s important to monitor them regularly from various perspectives. The number one profit KPI we advise our clients to track is gross profit percentage. We find this KPI to be crucial to monitor because it examines the two biggest controllable factors for your business: revenue and direct costs.

Monitoring gross profit percentage (GP%) allows you to isolate the controllable factors, which in return, can isolate the reason for any variance. GP% measures the efficiency of a business utilizing its input costs to produce profitable results from the sale of goods. For instance, if a restaurant sees a decrease in their GP%, they can look at the two factors that would be contributing: revenue and cost of goods. It could be very likely that they have experienced an increase in the cost of ingredients and may need to reevaluate their consumer price points or explore new vendors. On the other hand, if their cost of goods hasn’t increased, they may be experiencing a loss in business. From there, the business can determine why they have seen a decrease in customers and put together a plan to bring new customers in the restaurant.

GP% can be an incredibly valuable KPI to track because it isolates the general cause of a change, allowing for a deeper understanding of why there has been a change. With this knowledge business owners can make decisions that will directly impact the business in a positive way, rather than taking a shot in the dark and hoping for a change in the right direction.

If you’re considering taking on additional capital, you will want to have this information on hand. Gross profit percentage is important to investors due to the fact that it shows how profitable the company’s core functions are, without taking into consideration indirect costs. This KPI can be used to compare your business with others in the same industry, influencing your ability to take on investors.

Cash Flow KPI: Operating Cash Flow

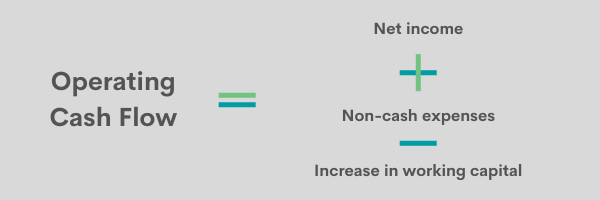

Cash flow troubles are the most commonly cited reason for new business failure, making it a vital KPI to monitor closely. Operating cash flow examines the total amount of money generated by daily operations within a specific time period, essentially measuring how sustainable a business is. The result will either be a positive or negative cash flow.

Operating cash flow can help a business owner determine if they have enough cash flow to continue with business operations without the need for loans or funding. If the operating cash flow is falling negative, it may be a sign the business needs to acquire additional funding in order to keep the wheels rolling. It’s best to monitor operating cash flow regularly to identify signs of a decrease before cash flow dips too low. The goal is to increase operating cash flow over time, meaning that the business is able to increase capital without funding.

Self-sustainability is crucial to a business and can indicate overall financial health. However, as the business grows, there may come a time when funding is necessary—such as new product development or other activities that require immediate investment in order to increase cash flow in the future. Having operating cash flow data to present to investors or lenders will help them assess the business’s health, profitability, status, and the likelihood of them getting their money back.

How to track KPIs

The key to tracking the most important KPIs is consistency, using reliable, accurate data. Cloud-based accounting apps, such as Xero, provide a central hub to organize your financial data. Pulling the information needed to track essential KPIs is quick, simple, and accurate with real-time, up-to-date data.

If accounting and the finance side of your business is just not your area of expertise, you don’t have to do it alone. Enlisting the help of an outsourced CFO can help you as a business owner understand KPI basics, how to implement them, and any additional metrics to monitor for your unique business. Outsourced CFOs provide financial expertise to small to midsize businesses without the need or budget for a full-time CFO. They can provide you with varying levels of assistance and work with you to elevate your business to the next level.

Without these two most important KPIs, business owners won’t have the information needed to make business decisions about the future of the business such as taking on more capital, product improvements, development of new business opportunities, and hiring staff. Whether you take on KPI reporting yourself or bring on the help of an experienced financial expert, don’t forget to monitor the above two KPIs regularly, using reliable data. Send us a message to schedule a meeting to gain a better understanding of KPIs or cloud-based accounting tools to adopt to make the process simplified.