18 APRIL 2025 UPDATE: After April 18, 2025, taxpayers will no longer be able to file amended returns to claim the credits associated with Form 7202. Consequently, Form 7202 will become obsolete and will not be applicable for any tax years beyond 2021. It’s important to note that these credits were specifically designed for the COVID-19 pandemic response and do not extend to subsequent years.

Therefore, after April 18, 2025, Form 7202 will no longer serve any purpose for taxpayers, as the window to claim the associated credits will have closed.

________________________________________

Were you self-employed in 2020 or 2021 and had to miss work due to COVID-19? Perhaps you were sick or had to take care of a child or family member. If so, you may be eligible to claim tax credits.

If you’re self-employed or part of the gig economy, you’ve likely been bombarded with ads promising significant tax credits. Some ads promise tax credits as high as $32,220 for those who were impacted by the pandemic.

These offers may seem enticing, but it’s crucial to separate fact from fiction. We want you to understand Form 7202 and the available tax relief.

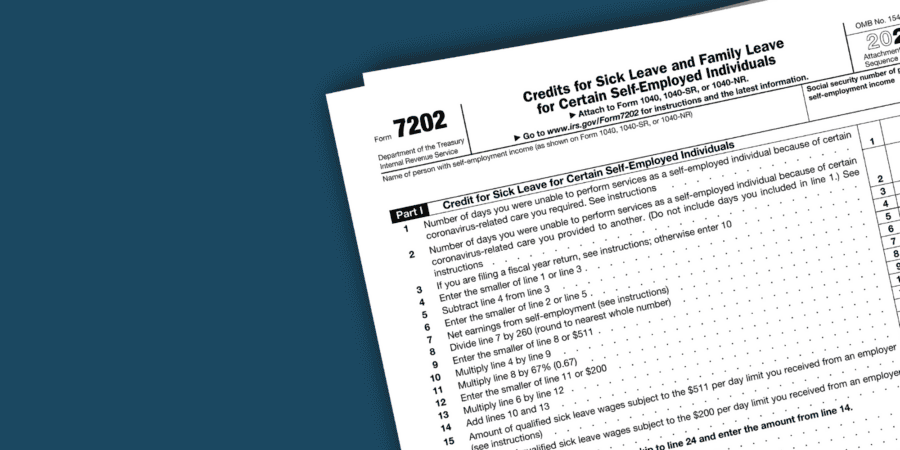

What is IRS Form 7202?

IRS Form 7202 allows self-employed individuals to claim tax credits for sick and family leave provided under the Families First Coronavirus Response Act (FFCRA) for tax years 2020 and 2021. This form allows eligible individuals to recover a portion of the wages lost while unable to work due to COVID-19-related reasons.

Before we dig in, here are the highlights you need to know:

- Eligibility Criteria: To qualify for the tax credit, self-employed individuals must fulfill specific criteria.

- Documentation: Documenting the inability to work is a crucial aspect of claiming the tax credit.

- Exclusions: It’s imperative to note that individuals cannot claim the tax credit if they were receiving compensation from another employer during the period of incapacity.

- Compliance: Individuals must ensure compliance with IRS guidelines when claiming tax credits. Attempting to exploit loopholes or make inaccurate claims can increase your risk of audit and lead to fines or legal repercussions.

- Filing Period: If you had sick and family leave during the eligible period but did not take advantage of this tax credit, you can file an amended return within three years after filing the original.

What are the requirements for filing IRS Form 7202?

IRS Form 7202 is for self-employed individuals and gig workers, such as contractors and delivery drivers. It allows you to claim tax credits for sick and family leave under the FFCRA.

The criteria for IRS Form 7202 are specific. You must meet certain requirements to claim tax credits, including:

- Inability to Work Remotely: You must demonstrate that you were unable to work, even remotely, for up to two weeks during the specified period from April 2020 to March 2021 due to COVID-19-related reasons. These include illness, quarantine, or caring for a sick family member or child due to pandemic-related school or daycare closures.

- Documenting Inability to Work: It’s important to document your inability to work during the specified period. Your documentation serves as evidence to support your claim. It may include medical records, quarantine orders, or other relevant documentation proving your COVID-19 diagnosis or exposure.

- Compliance with IRS Guidelines: You must ensure compliance with IRS guidelines when documenting your inability to work and claiming the tax credit. This includes accurately completing Form 7202 and providing all necessary supporting documentation as required by the IRS.

- Exclusion Criteria: You cannot claim the tax credit if you were receiving compensation from another employer during the period in which you were unable to work. The exclusion criterion prevents double-dipping and ensures that the tax credits are targeted towards those truly affected by the pandemic.

How much is the tax credit amount for IRS Form 7202?

The tax credit amount for IRS Form 7202 varies based on your circumstances and individual situation. Here’s how to calculate the credit:

- Base Credit Amount: Eligible individuals can receive a base credit amount of up to $511 per day for sick leave due to COVID-19-related reasons. If you were unable to work due to illness or quarantine, you can claim up to $511 per day as a tax credit.

- Additional Credit for Family Care: In addition to the base credit amount, eligible individuals can also receive a credit if they were caring for a sick family member or providing childcare due to pandemic-related school or daycare closures. If you had to take time off work to care for a sick family member or provide childcare, you can claim up to $200 per day as an additional tax credit.

Example for Individuals: Let’s say John, a self-employed individual, was unable to work for 10 days because he tested positive for COVID-19. During this time, he was unable to work remotely and had to focus on his recovery. In this scenario, John can claim a base credit amount of up to $511 per day for each of the 10 days he was unable to work due to illness.

Example with Family Care: Now, let’s say Moira, another self-employed individual, had to take care of her sick child for 5 days because her child tested positive for COVID-19. During this time, Moira was unable to work remotely and had to provide care for her child. In this scenario, Moira can claim a base credit amount of up to $511 per day for each of the 5 days she was unable to work. Plus, she can claim an additional $200 per day for providing childcare, totaling up to $711 per day for each of the 5 days.

The tax credit amount for IRS Form 7202 is based on the number of days you were unable to work due to COVID-19-related reasons and whether you were caring for yourself or a family member during that time.

Is it too late to file Form 7202 for a prior year?

No, but it’s getting close. Suppose you qualify for the tax credit but did not claim it by filing Form 7202 previously. In that case, you can file an amended return within a three-year period after filing the original, up until April 18, 2025. So for example, if you had sick or family leave that occurred between Jan. 1, 2021, and March 30, 2021, but you did not take advantage of this tax credit, you would need to file an amended return by April 15, 2024.

Beware of misleading ads and claims.

The recent surge in ads promising large tax credits for self-employed individuals related to Form 7202 is primarily driven by the availability of tax relief measures introduced in response to the COVID-19 pandemic.

These ads typically highlight the potential tax benefits available and may tout the ease of claiming the tax credits. They typically suggest that individuals are entitled to significant financial relief without fully understanding the eligibility criteria or documentation requirements.

While these ads can certainly seem enticing, you should approach them with caution. It is essential to thoroughly understand the eligibility criteria, documentation requirements, and compliance obligations before pursuing any tax relief measures advertised.

Should I get professional help with Form 7202?

The complexities of IRS Form 7202 and the available tax credits require careful consideration. Understanding Form 7202 and the eligibility criteria is crucial for claiming tax credits accurately. Documenting the inability to work due to COVID-19-related reasons and ensuring exclusion from other compensation are essential steps in this process. By meeting these requirements and accurately completing Form 7202, you can access valuable financial relief to help overcome the financial impact of the pandemic.

In navigating the self-employed tax credit maze, we encourage you to seek professional assistance if you have any questions or concerns. Tax professionals can provide invaluable guidance and ensure compliance with IRS guidelines, maximizing available benefits while minimizing the risk of audits or penalties.

Am I eligible for other small business tax deductions?

Curious if there are other tax deductions you could take advantage of? Interested in learning more about the best small business tax deductions for the self-employed? If so, we have put together a comprehensive guide of small business tax tips and strategies for tracking expenses, using detailed examples to help you take advantage of these tax savings.

Download our comprehensive guide: Small Business Tax Deductions – Your guide to understanding the overall impact of business expenses. If you have specific questions about your unique situation, feel free to contact us today to schedule a consultation.

You may also be interested in: