In the world of small business finance, staying on top of your numbers is non-negotiable. But it’s not just about crunching numbers; it’s about understanding the story they tell. That’s where your financial statements come in to help you make informed decisions. The three major types of financial statements every small business owner should know are the following:

- Balance Sheet

- Income Statement

- Cash Flow Statement

Let’s look at each one in more detail.

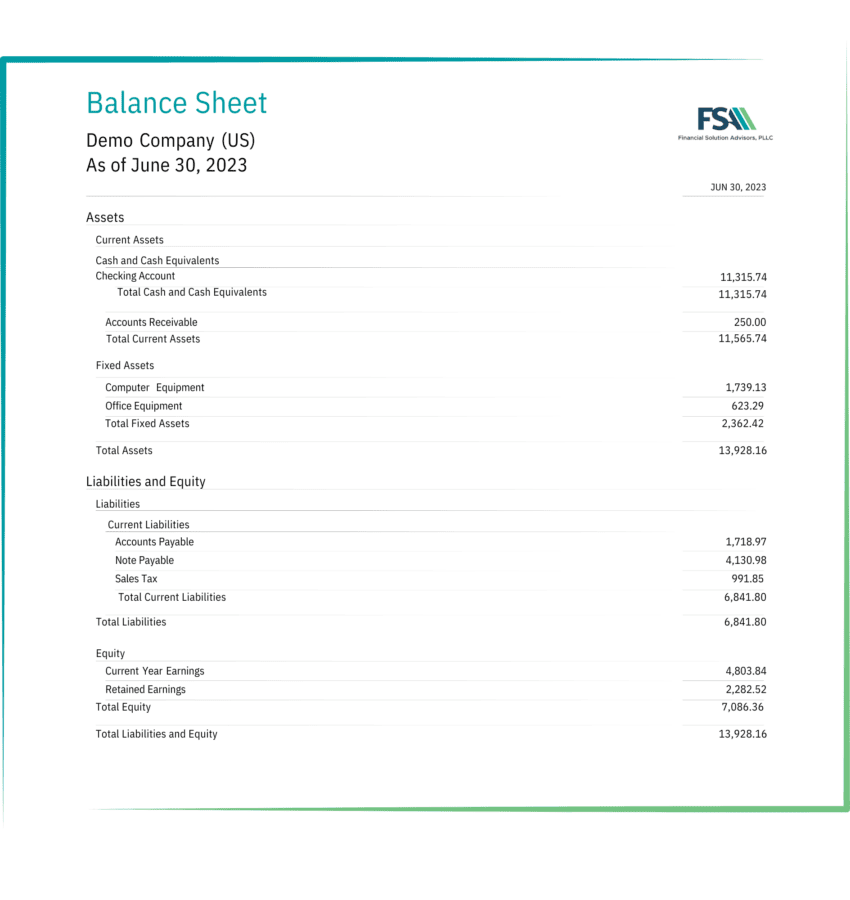

Balance Sheet

Think of the balance sheet as a snapshot of your business’s financial health at a specific point in time. It’s like taking a picture of your assets, liabilities, and equity to see how everything adds up.

Here’s a quick breakdown of the key components:

- Assets: These are the things your business owns that have value, such as cash, inventory, and equipment. Assets are divided into current (short-term) and non-current (long-term).

- Liabilities: These are your business’s financial obligations, like loans or unpaid bills. Like assets, liabilities are split into current and non-current.

- Shareholder’s Equity: This represents the portion of the business owned by shareholders, which is calculated as assets minus liabilities.

Remember this key equation:

Assets = Liabilities + Shareholder’s Equity

If everything is in order, these three components should always balance.

Sample balance sheet for a small business

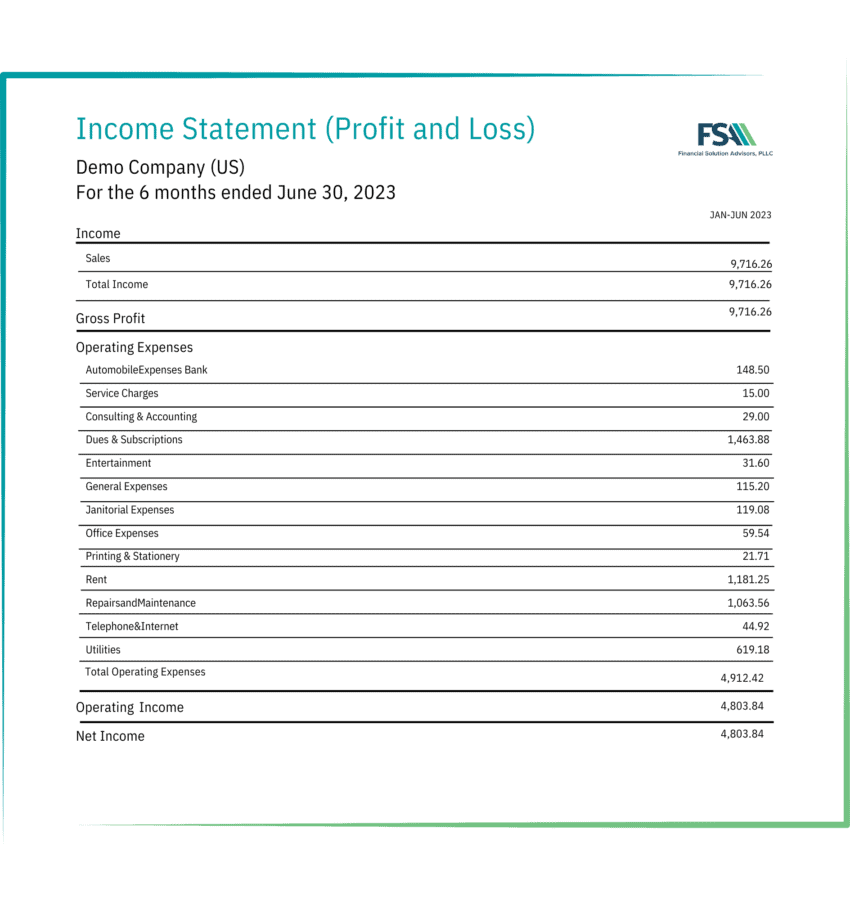

Income Statement

The income statement, also known as the Profit and Loss (P&L) statement, is where you’ll find a summary of your business’s revenues and expenses over a specific period. It tells you whether your business is making a profit or incurring a loss.

Here’s what you’ll typically find on an income statement:

- Revenue: This is the money coming into your business, often from sales.

- Expenses: These are the costs associated with running your business, such as salaries, rent, and utilities.

- Cost of Goods Sold (COGS): This is the cost of producing what your business sells.

- Gross profit: Your total revenue minus the cost of goods sold.

- Operating Income: Gross profit minus operating expenses.

- Income before taxes: Operating income minus non-operating expenses.

- Net Income: Income before taxes minus taxes.

- Earnings Per Share (EPS): Net income divided by the total number of outstanding shares.

- Depreciation: Reflects the reduction in value of assets over time.

- EBITDA (earnings before interest, taxes, depreciation, and amortization): A measure of a company’s operating performance.

You can analyze your income statement using two methods:

- Vertical analysis (expressing line items as percentages of gross sales)

- Horizontal analysis (comparing changes in dollar amounts over multiple periods)

Sample income statement for a small business

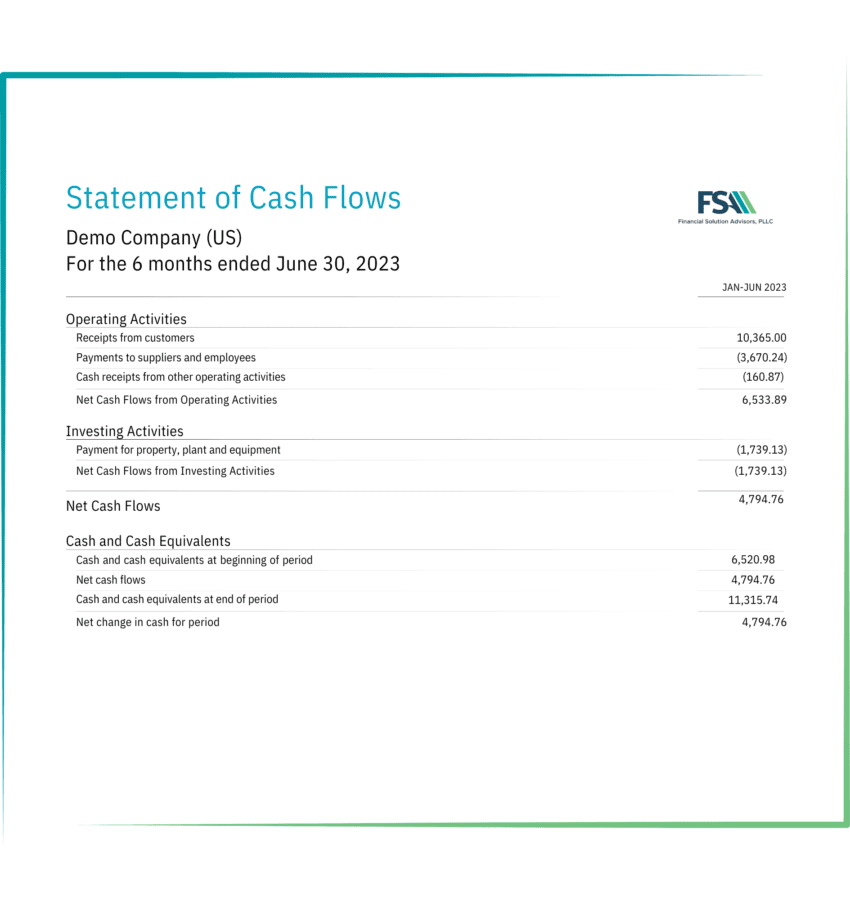

Cash Flow Statement

The cash flow statement is all about tracking the movement of cash in and out of your business.

It’s divided into three sections:

- Operating activities: Cash generated from day-to-day business operations.

- Investing activities: Cash flow related to buying and selling assets.

- Financing activities: Cash flow from raising capital or paying off debt.

A positive cash flow means more money is flowing in than out, allowing you to reinvest, settle debt, or grow. Conversely, a negative cash flow signals that more cash is going out than coming in, which can be a red flag.

Sample cash flow statement for a small business

How these statements work together

Your small business financial statements are interconnected. For example, the income statement feeds into the balance sheet through the net income account. Net income from the income statement increases the equity balance on the balance sheet. This connection ensures that your financial picture remains accurate and consistent.

Preparing accurate financial statements

To ensure the accuracy of your financial statements, apply three basic principles:

- Recorded facts: Use the original or historical cost of accounts when recording transactions.

- Accounting conventions: Consistently apply accounting standards from year to year to make your statements comparable and realistic.

- Personal judgments: Base your financial statements on personal judgments to avoid overstating assets and liabilities.

Read more: 4 accounting best practices every business should follow

Get smart about your small business financial statements

Understanding and regularly updating your financial statements is crucial for the financial health of your small business. Remember, automation and consistency are your allies in maintaining accurate financial statements. If you’re a small business owner using cloud accounting software and keeping your books up to date, then generating your financial statements is an easy process.

At Financial Solution Advisors, we’re here for all your small business financial needs, and we’re happy to take the time to run through your financial statements with you to give you important insights to keep growing your business. Reach out to the team to schedule an appointment.