An income statement isn’t just a spreadsheet full of numbers designed to make your eyes cross—with the right understanding, the small business income statement tells the financial story of your business. Think of it as a backstage pass to your financial performance, revealing how much money you’re making, where it’s coming from, and where it’s going. This detailed overview of your business revenue and expenses allows you to make data-driven decisions to improve profitability.

What is a small business income statement?

An income statement, also known as a profit and loss statement or P&L, is the financial GPS for your small business. It presents a comprehensive overview of your company’s revenues and expenses during a specific accounting period: it takes your total revenue (how much money you’re earning) and subtracts your expenses (how much money you’re spending) to give you the crucial number: profit or loss.

Business owners leverage income statements in conjunction with other key financial documents, such as balance sheets and cash flow statements, to assess and improve a company’s financial well-being. An income statement can be prepared monthly, quarterly, or annually, serving as a valuable tool for evaluating cash flow, predicting future performance, and enhancing overall business health.

What’s the difference between an income statement and a balance sheet?

An income statement focuses on presenting revenue and expenses over a designated period, revealing the profitability of a business during that time. A balance sheet, on the other hand, provides a snapshot of your company’s assets, liabilities, and owners’ equity at a particular point in time, showcasing the overall financial position and indicating the relationship between assets and liabilities.

You may also be interested in: A quick guide to the basics of small business accounting

When should small businesses generate an income statement?

For a small business, it’s best practice to generate an income statement monthly during the first year, and potentially quarterly for the second. However, that recommendation comes with a lot of caveats. Businesses going through a lot of changes, growing significantly, making major investments, raising funds, preparing for an owner exit, or any other number of conditions will be reviewing their income statements more frequently. When the books are up to date, small business income statements can typically be generated in a few clicks using any cloud accounting platform.

Streamline your month-end accounting process with our comprehensive checklist.

Download our free Month-End Accounting Checklist to take control of your month-end close.

Why your income statement matters

Doesn’t my accountant or accounting software just generate the income statement for me? Well, yes, but we highly recommend that you take a good look at it!

Wouldn’t you like to know:

- Where you are making money?

- Where you are spending money?

- If the business is profitable?

Whether you’re a member of the leadership team in a non-accounting role or an entrepreneur, understanding your income statement can provide a deeper understanding of your small business’ financial metrics. And what’s the first thing investors and lenders ask for? You guessed it—the income statement. An income statement paints a clear picture of your financial performance over a designated time frame, conveying valuable insights to executives, stakeholders, and investors alike.

What does an income statement include?

- Revenue: all revenue streams generated by the business during a reporting period

- Costs of goods sold (COGS): all the costs related to the sale of products in inventory

- Gross profit margin: the difference between revenue and cost of goods

- Operating expense: how much money a business spent during a reporting period on costs associated with the operations of the business

- Operating income: Gross profit minus operating expenses

- Total expenses: the sum of COGS and operating expenses

- Net profit: the difference between gross profit margin and total expenses

- EBITDA: Earnings before interest, depreciation, taxes, and amortization shows the capacity of a business to repay its obligations

- Net income: Income before taxes

- Finance costs: the costs of financing arrangements, such as interest on bank loans

- Earnings per share (EPS): Net income divided by the total number of outstanding shares

- Depreciation: the value lost by assets (such as inventory, equipment, vehicles, and property) over time

You may also be interested in: Accounting terms all business owners should know

Sample income statement for a small business

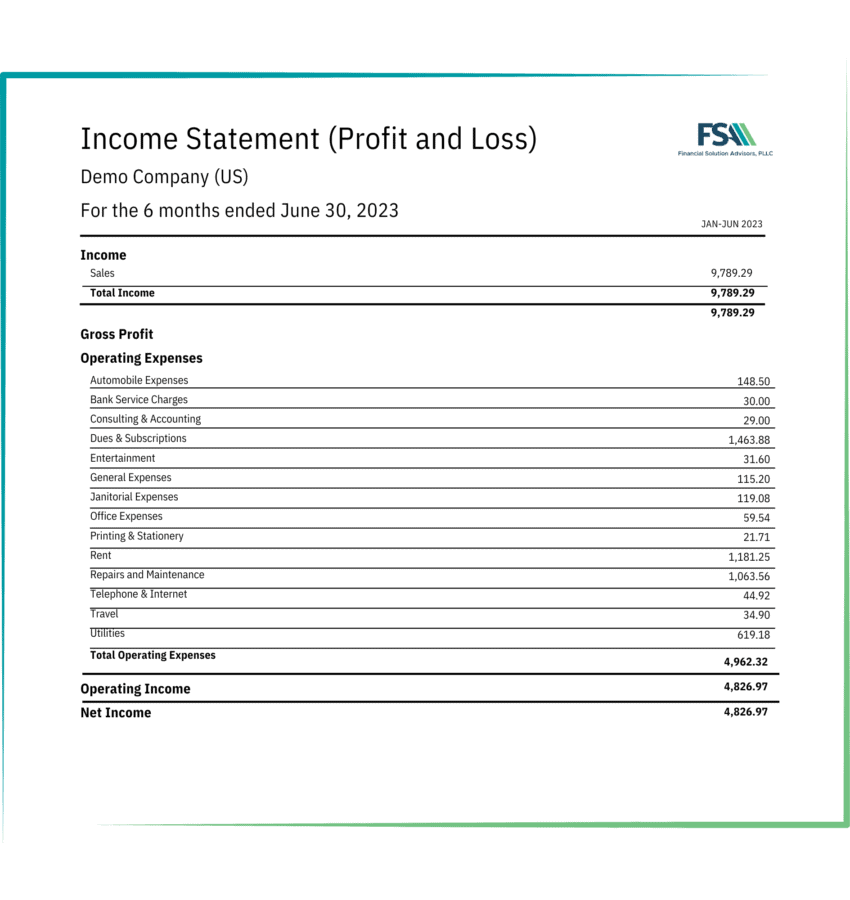

In most cases, a single-step income statement will look something like this:

Disclaimer: This sample income provided is for illustrative purposes only and may not reflect actual financial data.

This simple version shows a Demo Company’s income and expenses for January through June of 2023. At the bottom, the operating income is the gross profit less the operating expenses for the time period. Net income takes any non-operating expenses (e.g. interest payments on loans, taxes, etc.) out of the operating income; in this case, the operating income and net income are the same.

How to prepare an income statement for a small business

Good news: if you’re a small business owner using cloud accounting software and keeping your books up to date, then generating an income statement is an easy process. The important thing is to ensure you’re reviewing it regularly and incorporating the data as you make important decisions about the trajectory of your business. It’s not just a routine report; it’s the key to unlocking insights that can drive your success.

At Financial Solution Advisors, we’re here to guide you through every aspect of your financial journey, and we’re happy to take the time to run through your income statement with you to give you important insights to keep growing your business. Reach out to the team to schedule an appointment.