July 24, 2018

Financial Solution Advisors has been named one of Jacksonville’s 2018 Best Places to Work and has been featured in the Jacksonville Business Journal. “Here at Financial Solution Advisors, we value our employees and encourage them. We strive to provide a work environment that is conducive to achieve high productivity and growth opportunities, which add to […]

July 18, 2018

Listen, we get it. All these crazy new technology fads can feel a little, well, annoying. Can’t I just do things the way I’ve always done them? Why do I need to put everything on the cloud? Isn’t that how hackers found all those embarrassing celebrity photos? My way or the highway and that’s just […]

June 13, 2018

If you’ve decided to start a business, you’re going to find yourself focusing on your creative idea—the thing you’re so passionate about doing that you’ve decided to make it your livelihood. That’s where you’re the expert. There are, however, a whole mess of other things you should do if you’re really serious about running a […]

April 30, 2018

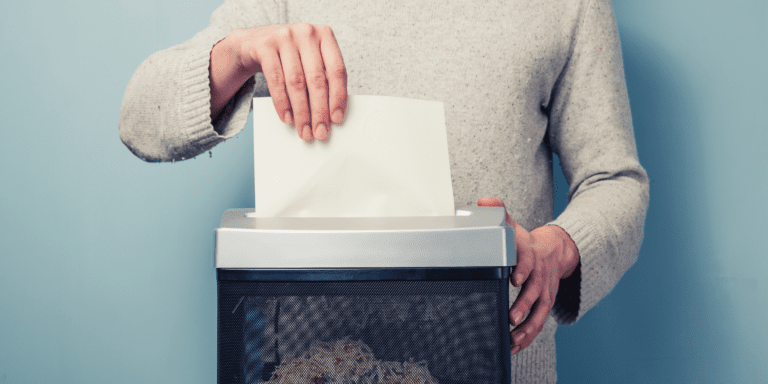

To Shred or Not to Shred… With tax season coming to an end, it’s a good time to organize your documents and properly dispose of any records you no longer need. In most cases, the IRS only has three years after the due date of your return (or the date you filed) to perform an […]

March 1, 2018

The IRS warns taxpayers of a new twist on an old scam. Criminals are depositing fraudulent tax refunds into individuals’ actual bank accounts, then attempting to reclaim the refund from the taxpayers. Here are the basic steps criminals follow to carry out this scam. The thief: Hacks tax preparers’ computers to steal taxpayer data. Uses […]

February 20, 2018

The Internal Revenue Service failed to tell nearly half a million victims of identity theft last year their information was being used by others for employment purposes, according to a new report, which attributed the failure to a computer programming error. The report, from the Treasury Inspector General for Tax Administration, found the programming […]

February 13, 2018

Xero recently announced the next phase of its partnership with Stripe: enabling Xero customers to accept Automated Clearing House (ACH) bank transfers via its integration with Stripe. “Our ultimate goal at Xero is to make sure small businesses are getting paid as quickly as possible, while making the experience from set up to reconciliation seamless,” said Craig […]

January 23, 2018

We check our phones about 85 times a day. Chances are, you’re reading this on one right now – or it won’t be long till you check it again. A staggering 70% of internet traffic now comes from mobile devices. This ‘smartphone addiction’ gets bad press these days. For any small business owners, rather than a […]

December 4, 2017

It’s that time of year again… Okay, let’s break this down: If you paid an independent contractor or non-incorporated company $600 or more during the calendar year, you should issue a 1099 (When it comes to attorneys, you should issue a 1099 to them even if they are incorporated). Your 1099 includes any payments for […]

October 31, 2017

One of the most important financial statements your small business has is a profit and loss statement. As a start-up, your P&L statement is critical for analytical reasons, but it can also be used to assist you in getting the loan you need to finance your idea. It gives investors a clear overview of your […]

October 26, 2017

Today’s the day! The day our team has anticipated for the last month, as we’ve watched the donation pile grow with each passing day! Today, we were able to load all of those donations into a Uhaul, and send them to down to Orlando to be shipped out to our 40 Families in the Virgin […]

October 20, 2017

Growing Our Impact with the Help of Partners The response we’ve received from friends, clients, and local businesses wanting to help us with our 40 Families in the Virgin Islands project has been overwhelming. We’re so proud, and beyond blessed, to announce that we have partnered with two local businesses as drop off sites for […]

October 12, 2017

“Xero for us, was the perfect tool to give us the ability to easily understand what our financials look like at the moment” says Sebastian. Sebastian Freude, chief of staff at San Francisco-based Good & Co, has a belief that there are no bad employees or companies – just a bad fit. So it’s no […]

October 10, 2017

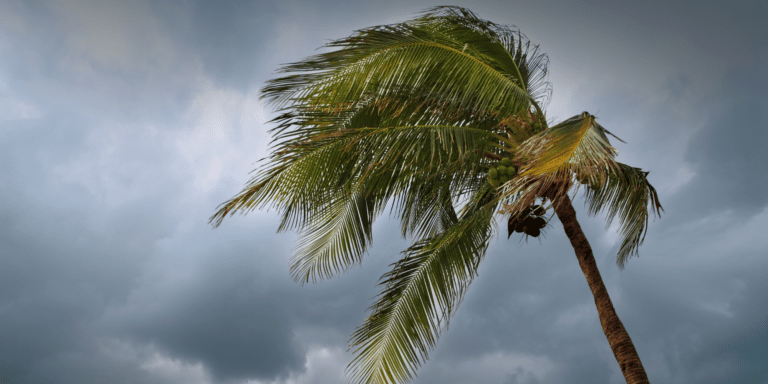

How Hurricane Irma Proves Your Business Needs To Be on The Cloud Last month, Hurricane Irma set new flooding records in Florida and the Florida Keys. In Jacksonville, we saw our own share of apocalyptic conditions. Hurricane downfalls left over 5 feet of water in their wake, surpassing the previous 1960s record of 49 inches. […]

September 22, 2017

Equifax said Thursday that 143 million people could be affected by a recent data breach in which cybercriminals stole information including names, Social Security numbers, birth dates, addresses, and the numbers of some driver’s licenses. Additionally, credit card numbers for about 209,000 people were exposed, as was “personal identifying information” on roughly 182,000 customers involved in credit […]

September 7, 2017

After the devastation of Hurricane Harvey and with Hurricane Irma threatening parts of the U.S. and Caribbean, the IRS reminds taxpayers that the agency is here to help. Individuals, businesses and organizations are encouraged to prepare for a variety of disaster and emergency situations in the following ways: Create Electronic Copies of Key Documents Taxpayers […]

September 5, 2017

Over the last 10 years, technology has driven huge amounts of change in the finance sector, redefining the very foundations the industry was built on. This fintech revolution is being powered by a wave of disruptive startups. They are completely reshaping the finance sector, otherwise known as the ‘root and branch reconfiguration’ of the ageing […]

August 28, 2017

The effects of Hurricane Harvey and the flooding in Texas have prompted many people to open their hearts and wallets to try to help the victims. Unfortunately, events like these provide an opportunity for scammers. The Better Business Bureau issued an advisory Monday with these reminders: 1. Don’t fall for copycats. Double-check the name of […]

August 22, 2017

Research suggests more than one-fourth of start-ups fail due to a cash crisis. While profits look appealing on an income statement, cash pays the bills. If you’re struggling to convert your sales into cash fast enough, consider the following ways for your business to get paid faster. Invoice Immediately Using Email Your clients aren’t obligated […]

August 18, 2017

Xero, the accounting software that allows ours clients to understand and grow their business every day, exists to empower small businesses. This is why there’s no greater reward than to receive positive praise from small businesses owners and key decision makers themselves. 5 out of 5 overall satisfaction In an annual survey conducted by Canstar […]

August 1, 2017

Article reposted with permission from Xero. A huge congrats is in order for our app partner, Receipt Bank. In one of the biggest deals in UK fintech since Brexit, it’s just raised $US50 million in a Series B funding round, led by Insight Venture Partners. Receipt Bank is one of the most popular integrations in our app marketplace, […]

April 7, 2017

IRS to Use Private Debt Collectors Okay, here’s the scoop: The IRS will begin turning over taxpayer accounts to four private debt collection companies. These firms will be able to keep up to 25% of what they collect. Now before you start to curse the IRS under your breath, know this: the IRS utilized private […]

February 9, 2017

Teach a man to phish, and he will come up with all sorts of new scams. This IRS has recently renewed its warning about an email scam that targets payroll and human resources departments. The scam involves emails sent directly to Payroll/Human Resources requesting personal employee information such as Social Security numbers […]

January 26, 2017

On January 25, the Better Business Bureau issued a warning about a new email phishing scam that targets the users of Intuit’s QuickBooks accounting software programs. The scam email contains a subject line of “QuickBooks Support: Change Request” and looks like a legitimate email from Intuit. The body of the email requests a confirmation about […]

September 27, 2016

The IRS has issued a warning of a new email scam mentioning the Affordable Care Act (also known as the ACA or “Obamacare”). The email appears authentic and includes a fake Notice CP2000 attachment. A Notice CP2000 is a form the IRS uses to notify taxpayers when income reported to them by third parties does not […]

August 9, 2016

The second annual Pediatric Cancer Family Foundation Color Me Gold 5k is coming up on September 17th, 2016! Financial Solution Advisors, PL is helping to sponsor this event again this year and we will have a team of runners at the event! The Color Me Gold 5k is an opportunity to raise funds for PCFF’s […]

May 18, 2016

The new overtime regulations for full-time workers have passed. Employers will now be required to pay time and a half for overtime if a full-time worker makes less than $47,476 per year. While this is less than the originally proposed amount of $50,400, it it about double the previous threshold of $23,660. If an employee works […]

February 22, 2016

In addition to providing excellent service, Financial Solution Advisors, PL has been named one of the 2016 Best Places to Work in Jacksonville, by the Jacksonville Business Journal. Out of the hundreds of applicants, Financial Solution Advisors was one of a dozen honorees in the extra small category covering companies with 10-24 employees. In addition […]

January 4, 2016

A common question we deal with is when to capitalize and depreciate assets rather than expensing them. It is often advantageous for a client to be able to expense smaller purchases rather than setting them up in depreciation schedules and either dealing with Section 179 rules or delaying the full deduction. The IRS has provided […]

November 16, 2015

In an off year election cycle, voters in St. John’s County Florida have elected to add a local sales tax rate of a half cent effective January 1, 2016. The new sales tax rate will be 6.5%, rounded up to the nearest penny. The money is intended for local schools as the St. John’s County […]

August 27, 2015

The Federal Labor Department has offered some new guidance on the difference between contractors and employees. The Labor Department has authority to do so under the Fair Labor Standards Act, although some argue that the new guidance contradicts previous court rulings. There has always been tension between employers and regulators when it comes to worker […]

June 25, 2015

We have received the SCOTUS ruling on the Obamacare subsidies. The Supreme Court handed down a 6-3 ruling in favor of the Affordable Care Act in the King v. Burwell case. The case centered on the question of whether the law provided assistance to individuals purchasing health insurance through the federal exchanges as well as […]

May 29, 2015

On May 26, the IRS reported that thieves had managed to access approximately 104,000 individual taxpayer accounts through the ‘Get Transcript’ application. Thieves gained access to the information by using information from third-party sources to login online and answer personal security questions. The question now is how you should be responding to the IRS breach. The […]

April 21, 2015

2013 saw a significant spike in tax return related identity theft. According to the IRS, cases of identity theft were up 66% for the filing season a year ago. Based on what we have seen this season, that statistic is sure to rise. Most people hate filing tax returns. Aside from being cumbersome, tax filings often come […]

January 15, 2015

We’re only partway through January, but W-2s, 1099s, and other tax documents are already starting to pour in. Tax season is underway. Are you ready? Chances are, you are more ready than the IRS. Due to Congress’ passage of last-minute tax law, the IRS has delayed the official opening of tax season. E-filing will become available January […]

December 29, 2014

As more states seek a bigger piece of the tax base pie, businesses are quickly discovering that every state has its own little quirks. Sales taxes are often the worst. Everything from the taxability of services to exemptions vary from state to state. Some states have tricky rules that make it difficult to determine where […]

November 20, 2014

There is no shortage of ways a taxpayer can run afoul of federal tax reporting requirements and find themselves in an audit. After all, the Internal Revenue Code (Federal Tax Law) comprised almost 74,000 pages as of 2013 and is growing each year. Despite the overwhelming quantity of information in the Code, you, the taxpayer, are required […]

November 7, 2014

Today I had the opportunity to teach a class of high school students about various tax forms, whether they should file a tax return, and some general principles for dependents of other taxpayers. It was a great group, and I had a lot of fun. Of course, I’m a tax geek. So teaching about tax […]

September 30, 2014

The 2014 income tax filing season is almost in the books. The corporate extension deadline has passed and the individual extension deadline is nearly here. Of course, this means it’s time to start doing tax planning for this year. As usual, there are some tax changes to be aware of as well as new strategies […]

August 26, 2014

2014 is a big year for changes in the health insurance world. The Affordable Care Act was set up to implement slowly over time and 2014 will see a lot of small business healthcare changes. Some of those changes will affect the Small Business Health Care Tax Credit. Currently, the credit is available for companies […]

August 15, 2014

In a recent tax court case, the IRS has successfully denied a “pizza deduction” for wages paid out in, well, pizza (Ross, TC Summ. Op. 2014-68). In this case, a small business owner who prepared taxes and did business consulting had “hired” her kids to do small jobs around the office and paid them in pizza. Rather than […]

August 4, 2014

The home office deduction has been alternately viewed as lucrative and dangerous. Does it raise your chance of getting audited? Can you really deduct your rent payment? The home office deduction is not a free-and-clear opportunity to live tax-free. However, taken correctly, it can help to reduce the costs associated with running a business out […]

June 18, 2014

This may seem like an obvious statement, but the expansion of e-commerce and logistical support systems has made interstate commerce far more prevalent than at any other time in our history. State revenue departments are paying attention. This can be especially confusing for companies in states like Florida that don’t have a personal income tax and […]

June 4, 2014

A Health Reimbursement Arrangement is an account funded by an employer to reimburse employees for medical care expenses. In the past, these arrangements have also been available to reimburse employees for purchasing their own private health insurance in lieu of having a company plan. In light of Obamacare, an important question arises: Does an Employer Funded Health Reimbursement […]

May 13, 2014

If you think publications printed by the IRS offering tax guidance are a final authority, think again. In a recent tax court ruling, the judge reinforced that the “plain language” of the law trumps IRS proposed regulations or publications (Bobrow). Basically, IRS Publications, which provide specific tax instructions for various situations, have been ruled unreliable. […]

April 16, 2014

MarketWatch is reporting this morning that former Secretary of Defense Donald Rumsfeld has sent his annual letter to the Internal Revenue Service stating that he does not know whether his return or the payments he made are in fact accurate. I certainly understand where Mr. Rumsfeld is coming from. I definitely agree with him that […]

January 30, 2014

In his recent State of the Union Address, President Obama introduced America to MyRA (or, “My Retirement Account”) for people who lack employer-sponsored retirement plans. He signed a presidential memorandum in Pennsylvania to make America’s new Savings Sweetheart official. The concept behind a MyRA is relatively simple: Taxpayers can sock away up to $15,000 into […]

January 21, 2014

It is a new year and Financial Solution Advisors, PL is expanding once again! In December, Sonny Martin joined the Financial Solution Advisors team, bringing his staff as well. Mr. Martin brings 35 years of public accounting experience to the firm. Together, the team provides a wide variety of services in public accounting, tax expertise, […]