All\\Tax & Financial Planning\\Individual Tax\\IRS\\Financial Planning\\Business Tax\\Business Financials

February 21, 2024

Combined sales of battery electric vehicles (BEV), hybrid vehicles, and plug-in hybrid electric vehicles in the United States rose to 16.3% of total new light-duty vehicle (LDV) sales in 2023, up from 12.9% in 2022. Could EV tax credits be playing a role? With the recent passage of the Inflation Reduction Act (IRA), the federal […]

February 13, 2024

Let’s be honest: none of us enjoys handing hard-earned money over to the IRS, but we’re all responsible for paying taxes. The good news is that taking advantage of tax-efficient investing and using tax-advantaged accounts allows you to retain more of your earnings and defer tax liabilities. Why is tax-efficient investment important? Taxes can eat […]

February 7, 2024

A burgeoning tech entrepreneur had an idea she believed could fetch $100 million in five years. She set up her business as a C-corporation—an unconventional move for a small startup. Why? Because she understood the potential of qualified small business stock under Section 1202. If you’re starting a small business with the intention of eventually […]

January 27, 2024

Hiring independent contractors for your business can reduce paperwork and tax payments, but it does require using 1099 forms for reporting purposes. There are numerous 1099s to report different types of non-employment income to the IRS during the tax year. In this quick cheat sheet, we’ll break down the differences between Forms 1099-MISC and 1099-NEC […]

January 18, 2024

Don’t forget: some big changes are coming for anyone earning more than $600 through a third-party settlement organization (TPSO). Whether you’ve generated income from Etsy, Airbnb, eBay, VRBO, Uber, or Amazon, you can soon expect to receive a Form 1099-K, which is also filed with the IRS. So, is 1099-K income taxable? And how will […]

January 17, 2024

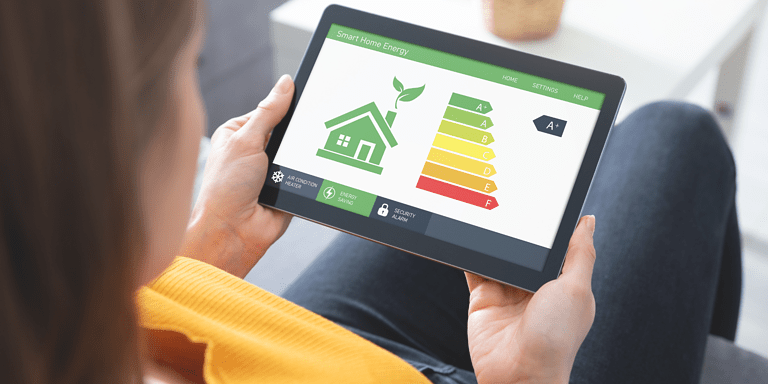

Held in January 2024, our 2023 wrap-up and 2024 financial planning webinar covered a number of key topics to ensure that our clients are well informed and equipped for the year ahead. Here are some of the key takeaways from the session: New tax credits for energy efficiency Homeowners eyeing energy-efficient upgrades, such as air-conditioning […]

January 10, 2024

In a significant move aimed at alleviating the financial burden on taxpayers, the Internal Revenue Service (IRS) has announced a waiver of nearly $1 billion in late-payment penalties for millions of individuals, businesses, trusts, estates, and tax-exempt organizations that were not sent automated collection reminder notices during the pandemic. Understanding the tax relief measures The […]

December 20, 2023

Research & development (R&D) drives innovation, competitiveness, and job creation in many industries. But in case you missed it, the Tax Cuts and Jobs Act (TCJA) altered Section 174 of the tax code that allowed companies to fully expense R&D costs in the year incurred. R&D costs are now amortized over five years for domestic […]

December 6, 2023

There’s a reason your car’s windshield is so much bigger than its rearview mirror. Sure, both can save you from having an accident, but there’s no doubt which piece of glass plays a bigger role in your safety. In the same way, you can panic when the tax deadline arrives, rush to take out a […]

November 16, 2023

DECEMBER 2024 UPDATE: On December 3, 2024, a Texas federal court issued a nationwide injunction prohibiting the enforcement of the Corporate Transparency Act (CTA), which would have required 32.5 million U.S. companies to report their beneficial ownership information (BOI) to FinCEN by January 1, 2025. The court ruled the CTA likely unconstitutional, citing its infringement […]

October 25, 2023

As a small business owner, you wear many hats, but you can’t expect to be an expert in everything from fundraising to finances. That’s why many business owners and managers seek out specialist advisory services. Ultimately, advisory services provide expert advice to help you solve problems and reach important goals. When you know you have […]

October 3, 2023

If you weren’t prepared to file your federal tax return in mid-April, you hopefully requested an extension by filing Form 4868. But what happens if you still haven’t been able to put your tax information together and also missed the October deadline? You may also be interested in: Everything you need to know about filing […]

September 28, 2023

Medical professionals and nonprofits face unique challenges when it comes to managing their resources effectively, from unprecedented cost pressures, regulatory challenges, and diverse revenue sources. A robust Financial Planning and Analysis (FP&A) strategy is crucial to navigating these complexities and making data-driven decisions that lead to long-term growth and sustainability. What is Financial Planning and […]

September 20, 2023

Running a small business comes with its fair share of financial responsibilities. One crucial aspect of managing your business finances is understanding and maximizing tax deductions. By identifying and properly categorizing your expenses, you can significantly reduce your taxable income. We can also help you tackle those tasks now—our expertise includes implementing frameworks into your […]

September 11, 2023

In the world of small business finance, staying on top of your numbers is non-negotiable. But it’s not just about crunching numbers; it’s about understanding the story they tell. That’s where your financial statements come in to help you make informed decisions. The three major types of financial statements every small business owner should know […]

September 1, 2023

Your small business might offer the best product or service the market has ever seen, but if your finances aren’t in shape, you’re dead in the water. We know that not everyone’s a number nerd! Regardless of your feelings about your high school math classes, managing finances is one of the most critical aspects of […]

August 28, 2023

An income statement isn’t just a spreadsheet full of numbers designed to make your eyes cross—with the right understanding, the small business income statement tells the financial story of your business. Think of it as a backstage pass to your financial performance, revealing how much money you’re making, where it’s coming from, and where it’s […]

August 9, 2023

In accounting, the job is never done. We know all too well that, with process after process to deadline and cut-off, there’s barely a gap to breathe. But closing your books every month is time well-spent in the long run, helping you keep accurate records and a close eye on your finances throughout the year. […]

August 2, 2023

Sales tax for business owners is undoubtedly one of the most complex and specialized aspects of running a small business. With each state and locality having its own set of laws, tax rates, timetables, and exemptions, dealing with sales tax can be overwhelming and frustrating. And as online sales continue to surge, the complexities have […]

July 19, 2023

2025 UPDATE: The Department of Labor pauses enforcement of the Biden administration’s independent-contractor rule. On June 13, 2023, the National Labor Relations Board (NLRB) made a significant decision in The Atlanta Opera, Inc. case, which impacts the classification of workers as employees or independent contractors under the National Labor Relations Act (NLRA). The NLRB overturned […]

July 5, 2023

Caring for an elderly parent or adult dependent can be emotionally and financially burdensome. According to a study by AARP, caregivers spend an average of $7,242 per year on caregiving expenses. Thankfully, there are tax breaks available to help offset the cost of elder care. The name of the Child and Dependent Care Credit is […]

June 21, 2023

Owning a small business comes with myriad challenges. Don’t let fraud become one of them. It’s a common misconception that fraud can only happen to big corporations. But, according to an Association of Certified Fraud Examiners (ACFE) report, small businesses (those with fewer than 100 employees) are hit by fraud more frequently than large organizations […]

June 7, 2023

In a landmark move, Florida has taken a giant leap forward in expanding school choice options for students across the state. On March 27, 2023, Governor Ron DeSantis signed House Bill 1 (HB 1), a historic piece of legislation that eliminates financial eligibility restrictions and the enrollment cap for school choice programs. As of July […]

May 22, 2023

The federal tax return deadline for individuals falls on (or around, depending on the day of the week) April 15th every year. If you aren’t prepared to file by then, you can request a tax extension by filing Form 4868, which gives you an additional six months to file your previous year’s federal income tax […]

April 19, 2023

Many businesses need the use of a vehicle as part of their daily operations—meeting clients, delivering products, buying supplies, etc. If you use a car for business purposes, you’ll be able to deduct all of its related business expenses. Here’s how to go about it. How to calculate deductible car expenses If you use your […]

April 4, 2023

In our last economic update webinar, we discussed the hot topics of inflation, market swings, and what’s ahead for our economy. We also covered ways to protect your savings and how to invest in uncertain times, which resulted in a list of ten things you should be doing with your financial plan. Review these items […]

March 28, 2023

Last year, President Biden signed the Setting Every Community Up for Retirement Enhancement (Secure) 2.0 Act of 2022, a bipartisan retirement savings law that includes numerous retirement policy changes that will go into effect over the next decade. We wrote a blog to summarize some of the critical changes you need to be aware of […]

March 1, 2023

Tangible returns, property returns, personal property returns, tangible personal property returns, TPP, DR-405… you’re forgiven if you’re confused about personal and business property tax, especially because it differs from state to state. In Florida, tangible personal property (TPP)—as we’re going to call it—is a tax on businesses (not individuals, so don’t be fooled by the […]

January 31, 2023

Over the last few decades, the foreign affairs of U.S. citizens have come under increasing levels of government scrutiny. On November 4, 2022, the IRS issued a new draft set of instructions for an S-corporation’s 2022 Schedules K-2 and K-3; instructions for partnerships followed on December 23, 2022. The IRS finalized these instructions for 2022 […]

January 19, 2023

It’s officially tax season, and that means many small business owners are scrambling to clean up their books from the previous year in order to hand information over to their tax preparers. While some small business owners dread this time of the year, others have taken control of their books and are prepared. But what […]

January 18, 2023

Roth conversion (converting from a Traditional to a Roth IRA) can be an attractive prospect when the market is down; you can move your balance to the Roth IRA while the taxable amount is lower and then let it grow tax-free in the Roth account. There are various reasons to convert a Traditional IRA to […]

January 10, 2023

Any financial planner worth their salt will not simply sell you financial products, review your portfolio, or conduct an insurance analysis or retirement assessment. Of course, these elements are essential parts of a financial plan, but by no means do they represent the whole. The core of your financial plan is you—not the products, services, […]

December 20, 2022

The Work Opportunity Tax Credit (WOTC) is available to employers that hire individuals from targeted groups that have traditionally faced barriers to employment. For each WOTC-eligible employee hired, you’ll be able to reduce your federal tax liability. The WOTC is one of the most underutilized tax credits available to businesses. Read on to find out […]

December 7, 2022

These days, it’s not uncommon for at least part of your home to double as office space. Whether you work from the couch or run your business from a designated room, you should know the tax implications of setting up a home office and claiming the home office deduction. Does it raise your chance of […]

December 1, 2022

Tackling home improvements and reducing your tax bill at the same time? Sounds like a win-win! The recently passed Inflation Reduction Act includes expanded tax credits for energy-efficient home improvements, which some analysts have estimated could save over 100 million households $37 billion a year on their energy bills. The 2022 Inflation Reduction Act extended […]

November 29, 2022

Ongoing research and development (R&D) is a cornerstone of a prosperous economy, which is why the IRS provides a federal R&D tax credit under Internal Revenue Code Section 41. But the scope of R&D isn’t limited to large-scale scientific development (such as large pharmaceutical companies working on a new drug); small businesses also can and […]

November 22, 2022

Amid rampant inflation, the Great Resignation, economic uncertainty, and the new normal of the working world, many businesses will soon be adding another challenge to the list: higher tax bills brought about by changes to tax regulations. In this blog post, we take a closer look at some of the big tax changes on the […]

November 16, 2022

IMPORTANT UPDATE: On November 10th, 2022, a court struck down the Biden-Harris Student Debt Relief Plan, and the administration has now stopped accepting applications for federal student loan forgiveness. The department says it will hold the applications of borrowers who have already applied. For now, borrowers should sit tight and wait to see what happens. […]

November 7, 2022

In the third quarter of 2022, the hottest topics were inflation, market swings, and what’s ahead for our economy. In our October 25th, 2022, economic update, we addressed these topics, as well as proposed legislation and what to expect in the upcoming tax season. We also discussed ways to protect your savings and how to […]

October 28, 2022

It’s no secret that being a business owner can be an incredible opportunity, while also presenting significant challenges on a daily basis. Business owners are battling many different fronts, from keeping employees and customers happy to keeping up with rising demand and the costs associated with doing business. This is especially true when an economic […]

October 27, 2022

The Employee Retention Tax Credit (ERTC), also known as the Employee Retention Credit (ERC), is one of the few significant COVID-19 relief options that could still be advantageous for eligible businesses. But the rollout of the ERC was complex and subject to significant changes, which led to the rise of questionable companies creating confusion among […]

October 21, 2022

When it comes to financial planning, saving for retirement is a top priority. When we picture our golden years, we hope to be able to enjoy financial freedom, live comfortably, and perhaps even provide for others after we’re gone. One of the most popular vehicles for people with earned income to save for retirement is […]

September 23, 2022

The word audit can send a business owner into a nervous panic. But an audit isn’t always a serious issue, especially when conducted internally. Yes, there are audits performed by the IRS if there is reason to believe that taxes have not been paid accurately. However, small business owners often don’t realize that they should […]

September 20, 2022

The Inflation Reduction Act of 2022 was signed into law by President Biden on August 16, 2022. In addition to new taxes and credits, the Act directs $80 billion to the Internal Revenue Service (IRS). In this blog post, we summarize the Act’s tax revenue provisions, tax credits and deductions, IRS provisions, and how your […]

September 7, 2022

2022 not your year for earning potential? Many of us are still feeling the effects of the pandemic reflected in our income, AND we now have inflation to deal with. Perhaps you’ve been forced to take a break from work due to personal circumstances, or maybe your business just hasn’t done that well this year. […]

August 29, 2022

Whether you’re running a business, handling your personal affairs, or both, there’s no escaping the need for some level of financial accounting, bookkeeping, financial planning, and tax preparation. For many people, handling these financial elements is, at best, a drag; at worst, a costly omission or mishap. Fortunately, there are people out there who specialize […]

August 24, 2022

While building a successful family business takes a significant amount of time, effort and money, it can all come toppling down if you haven’t created a strong estate plan. According to PwC’s 10th Global Family Business Survey insights, family businesses make up more than half the world’s GDP and are massive contributors to social and […]

August 18, 2022

After months of negotiations, the Inflation Reduction Act of 2022 has been signed into law by President Biden. This act is a massive climate, healthcare, and tax bill that has the power to drive some real changes in our economy in the coming years. Here’s what we want our clients to know now. What is […]